PORTO HELI, Greece—For 20 years, the building had been an empty eyesore on the shores of this picturesque bay. Unable to keep up with the changing times, the 1970s-era hotel went bust, was seized by creditors, and eventually shut its doors in the mid-1990s.

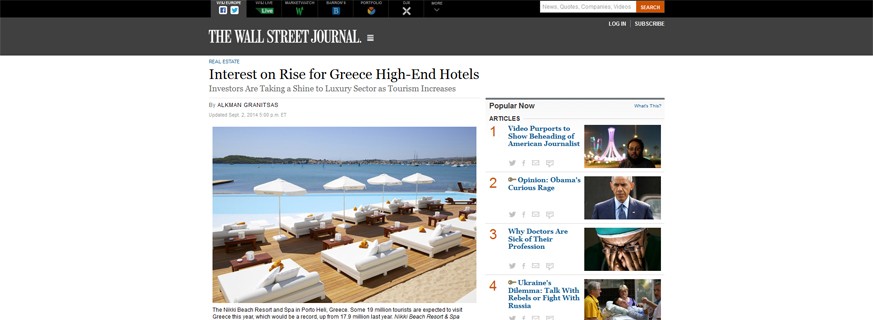

Today, Greece’s newest ultrachic, five-star hotel stands out on the location like a dazzling, postmodern sculpture visible from miles around. Rechristened the Nikki Beach Resort and Spa, it offers a Mediterranean cool ambience with well-heeled guests.

The hotel has only been open for a few weeks, but is already booked close to capacity for the rest of the summer, with rates ranging between €300 and €350 ($395 and $460) for a double room and up to €850 for a rooftop suite.

After several tough years, Greek tourism is on an upswing, attracting a share of the international jet set this summer. Celebrities like fashion model Naomi Campbell and actor Russell Crowe have been spied vacationing in the Greek isles this year.

And with the glamour, there is newfound interest by investors in Greece’s high-end hotel sector. Investors recently have purchased stakes in several resorts in recent months, including the Astir Palace hotel, a luxury beachfront property, and the Amanzoe, which overlooks the Aegean Sea.

Industry observers said that over €4 billion of new investments are being planned, all of them in the four- and five-star categories. Some observers said the country could face a shortage of four- and five-star hotel rooms this decade.

“What can I say? St. Tropez is out, Myconos is in,” said Andreas Andreadis, president of the Association of Greek Tourism Enterprises. “Greece is in fashion again.”

More than two dozen hotel projects stretching from Corfu to Crete are on the drawing boards. About half those projects are being financed by foreign private-equity companies like Oaktree Capital Management LP.

The others are being planned by Greek-led investment groups. International firms, such as Hilton Worldwide Holdings Inc., Four Seasons hotels, Abu Dhabi’s Rotana Group and trendsetting Nikki Beach Hotels and Resorts, are being courted to manage the properties.

Greece’s debt crisis has also created opportunities, said some investors. Land values are down between 30% and 50%, and labor costs have fallen by a fifth or more.

Meanwhile, Greece’s government is trying to cut red tape and turn around the country’s traditionally antibusiness climate. Last year, the government fast-tracked a British-led €267 million hotel and golf complex on Crete that had been languishing for 16 years. Construction is expected to begin next year.

Some 19 million tourists are expected to visit Greece this year, which would be a record, up from 17.9 million last year. The country is also benefiting from turmoil in rival Mediterranean destinations, such as Egypt or neighboring Turkey. According to STR Global, a hotel consultant, occupancy rates at Athens hotels rose to 83% at the end of May and 70% across Greece, jumping by more than a third from a year ago. Room revenue is up 46%.

“Getting deals done in the local environment remains a lengthy and difficult process, and uncertainties with key elements including permitting and grants persist,” said Spyros Spyropoulos, an adviser to Oaktree.

Still, Oaktree is forging ahead by teaming up with local resort operator Sani SA to set up a chain of hotels. “But we believe we have the right setup,” Mr. Spyropoulos said.

Most of the interest has been in developing new properties. Many of Greece’s stock of existing hotels are buried under a mountain of debt. According to one recent survey, as many as half of the country’s 9,700 hotels are unable to service their debts, while industry analysts said debt ratios for the sector are 15 times operating earnings, two or three times above what is considered viable.

But restructuring that debt could take several years while Greece’s banks nurse their balance sheets back to health and Greece’s government overhauls the country’s outdated bankruptcy laws.

“As long as the banks are not foreclosing, there is really limited scope for entry. Owners are not selling because of negative equity, and the banks are not willing to take any meaningful write-downs,” said Miltos Kambourides, founder of Dolphin Capital Investors Ltd. , a private-equity firm specializing in property investment. “Once the banking system becomes healthier, I expect the banks will write down the loans or else foreclose, and that will make deals possible.”

Dolphin Capital has already invested close to €400 million developing new projects in Greece, including the purchase and remodeling of the Nikki Beach resort, as well as the luxury Amanzoe resort nearby. and is planning on spending more than €1 billion over the next eight years. The company has plans to invest significant amounts in buying up existing hotel assets once they become available.

Dolphin brought in the Nikki Beach chain, based in Miami, to manage the Porto Heli property. It is Nikki’s first hotel investment in Europe. Jack Penrod, Nikki’s founder, said he is looking at adding two more properties in Greece.

“When we put out our feelers in Europe, Greece had some very favorable deals. The remodeled hotel cost about 40% less than building a new hotel, and the remodeling fit with what we wanted to do,” said Mr. Penrod.